Renting vs. Buying: What Does it Really Cost?

Some Highlights:

- The % of income needed to buy a median priced home is almost half the % of income needed for median rent.

- Buying costs are significantly less than renting.

- The % of income needed to buy a median priced home is less than renting.

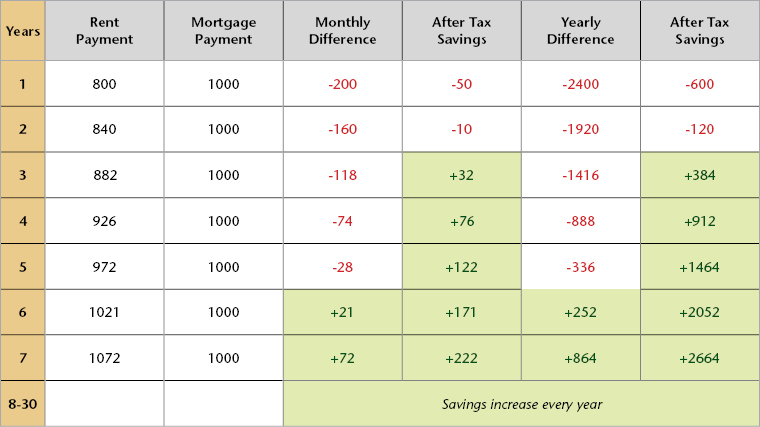

Buy v/s Rent Chart Comparison:

The homeowner’s payment is less than the rental payment after 3 years.

Listed below are typical requirements for Obtaining a Home Loan:

1. 600 Credit Score (no late payments within 12 months) Best Score 640 & above

2. 3.5% DownPayment for FHA Financing

For example: If sales price = $300,000 Then Down Payment = $10,500

0% Downpayment for VA Financing (for Veterans with a VA Certificate)

2. 3 months Bank Statements & Current Pay stub

3. Must be employed for at least 1 year (or in the same line of work if you’ve changed jobs within a year). Job must be in the same state your buying a home. If self employed, your tax returns need to confirm self employment.

4. Last 2 years Filed Tax Returns.

5. Any B/K must be minimum 1 year from discharge for FHA mortgages.

6. Any prior foreclosure must be 1 year from when the previous bank sold the property, assuming your credit has been re established.

Contact us directly for requirements on Commercial real estate.

5 Things to Impact or Increase Your Credit Score:

Your credit score will INCREASE significantly IF YOU IMPROVE what impacts your credit score.

You can monitor your credit score every month by signing up for a FREE account with Credit.com to monitor your credit score monthly.

You can also receive a personalized action plan to help you with your score on Credit.com. Consumers often think that it is the responsibility

of the lender or mortgage company to give them an action plan. Lenders are in the business of lending not credit repair.

Lenders typically only tell you whether your approved or denied.

Payment history, late payments, high debt & balances owed can account for

65% of your credit score.

1. Payment History (impacts 35% of your credit score)

Payment history accounts for how you have paid your bills in the past, what the balances are on your credit accounts, what type of credit you have & how many late payments have occurred.

2. Balances owed on your account (impacts 30% of your credit score)

Using more than 30% of your available balance lowers your score. For example, if your credit card limit is $1000, the debt on the card shouldn’t be more than $300 in an effort to keep your credit score from being negatively affected.

3. Length of credit history (impacts 15% of your credit score)

The longer you have accounts open the better.

4. New Credit (impacts 10% of your credit score)

5. Mix of Credit (impacts 10% of your credit score)

Mix credit are the types of diverse credit you have. Installment credit v/s revolving credit.

An example of installment credit is a mortgage or student loan. An example of revolving credit is credit cards.

This information can surely make an impact on whether you are pre approved for a loan.

Sign Up for your Free Credit Report & Get tips on how to establish credit.

Sign Up to Work With Us!

Pre-Approval Do’s & Don’ts

DO’s

- DO provide requested documentation promptly and in its entirety.

- DO continue living at your current residence.

- DO continue making your mortgage or rent payments.

- DO continue to use your credit as normal.

- DO keep working at your current employer.

- DO keep your same insurance company.

- DO stay current on all existing accounts.

DONT’s

- DON’T change your employment or marital status.

- DON’T make any major purchases (car, furniture, jewelry, etc.).

- DON’T change bank accounts.

- DON’T make any large cash deposits into your bank accounts.

- DON’T transfer any balances from one account to another.

- DON’T close any credit card accounts.

- DON’T consolidate your debt onto one or two credit cards.

- DON’T apply for new credit or open a new credit card.

- DON’T max out or overcharge on your credit card accounts.

- DON’T take out a new loan or co-sign on a loan.

- DON’T pay off any loans or credit cards, charge offs, or collections without discussing it with us first.

- DON’T finance any elective medical procedure.

- DON’T join a new fitness club.

- DON’T open a new cellular phone account.

- DON’T start any home improvement projects.

- DON’T have your credit pulled or dispute any information on your credit report during the loan process.